PEW Center on Cuts

Spending cuts outlined in the Continuing Resolution (CR) bill currently top out at $74 billion, but, with the Tea Party holding Republicans to principle, it will reach $100 billion (updated cuts here). Predictably, this bill has lots of bad news for Science and Technology in America; unfortunately, it maintains the status quo on oil and gas subsidies.

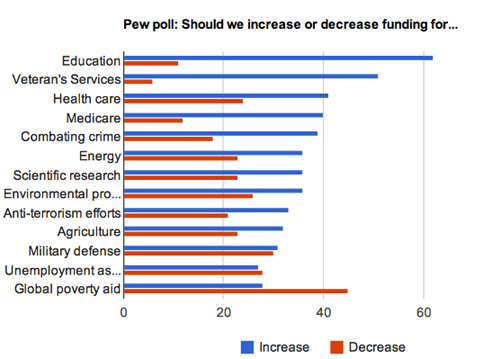

The biggest cuts are to Energy Efficiency and Renewable Energy (-$786.3 million), the Environmental Protection Agency (-$1.6 billion), the Centers for Disease Control (-$755 million), Clean Water Funds (-$950 million), and a cut of $893.2 million to Science. It hurts, but it’s important to keep perspective. Some of these cuts are merely cancelling out the unspent portions of the American Recovery and Reinvestment Act of 2009, and we’ve been reminded from both sides of the aisle that “very hard choices” will need to be made on the deficit. A look at the above Pew poll on where American’s think spending should be increased and decreased, and we have to admire the Republican Congress for taking such a political risk.

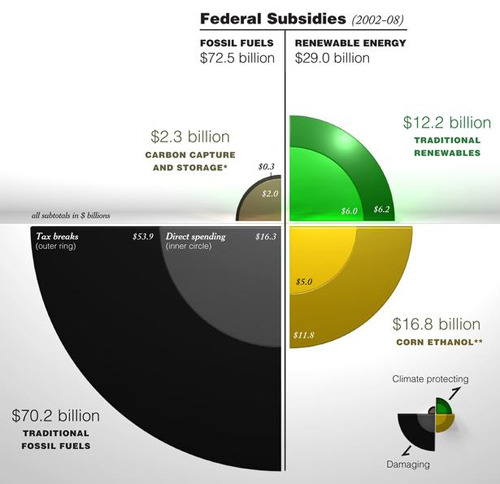

But the respect is tempered by the fact that, while cutting subsidies for alternative energies, Congress won’t make the truly hard choice of cutting subsidies for the entrenched Oil and Gas industry, which receives $10 billion annually in subsidies, more than five and a half times the federal subsidies for renewable energy from 2002 to 2008. Internationally, fossil fuel subsidies are 12 times greater than support for renewable energies, $46 billion compared with $557 billion in 2008. By maintaining tax subsidies that keep gas prices artificially low in the United States, the Federal government creates a distorted energy market where consumers cannot compare the true cost of fossil fuels to alternative energies.

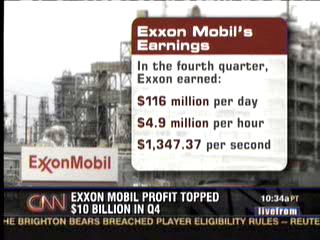

Meanwhile, companies like Exxon Mobile continue to rake in record profits each year as a subsidies keep gas prices artificially low. Exxon highly publicizes the fact that the company’s taxes exceed their earnings, but fail to point out that most of those taxes are paid to foreign countries or are paid entirely by consumers at the gas pump. Tax breaks for the oil industry actually result in our Federal government paying them each year while they send taxes overseas. Exxon Mobil’s federal tax liability was -$156 million while its international taxes were $15.2 billion.

Exxon Profits

Will the Federal government cut off this Oil Industry welfare system? Obama received $884,000 from the oil and gas industry during the 2008 campaign, 2010 congressional candidates recieved $17 million, with political contributions since 1990 totaling $238.7 million. In return for its lobbying in the past the oil industry received $16.2 billion in tax subsidies in the Securing America’s Future Energy Act of 2001, while Presidents Clinton, Bush Senior, and Reagan also increased subsidies for Oil and Gas.

House Democrats with Obama’s support want to end $40 billion in tax subsidies to the oil industry to cut another $4 billion a year from the federal deficit. The only ray of hope in this debate is the fact that the Tea Party freshman are not yet beholden to the Oil and Gas industry, giving them the power to pressure their party into supporting this fiscally responsible move. Cutting science funding is easy, scientists are a quiet lot, cutting Oil subsidies isn’t, politicians would have to face trillions of dollars in protest, but it needs to be done if we are to have a fair and realistic energy market.

Further Reading: